Minimizing taxes and building wealth are the pillars of a great financial strategy. A Registered Retirement Savings Plan (RRSP) is an excellent way to do both, but you need a long game to make it work the hardest. With careful, calculated planning it will contribute to your financial success in many ways.

Since its inception in 1957, the RRSP has remained popular for some good reasons. Your contribution provides a tax deduction today. The RRSP investments, as they grow steadily through the years, are not taxed until your retirement. Then, since your income is expected to be lower, withdrawing the money results in a lower tax bill. These basic principles offer many opportunities for a wealth strategist determined to leverage the opportunity.

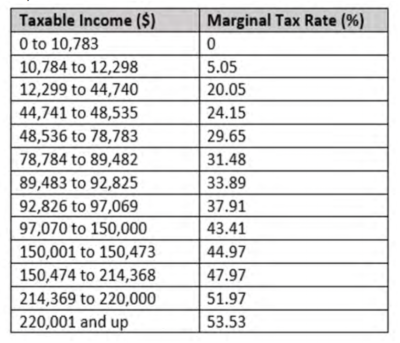

When should you start an RRSP? The marginal tax rate, or percentage of tax you must pay, will rise with your salary (see chart below).

In the early part of your working life, with a modest income, you don’t need the tax breaks. A smart move is deferring creating an RRSP until the time your salary increases. Another option is to start your RRSP early, to enhance long-term investment growth, but postpone claiming those contributions.

The yearly contribution limit continues to accumulate throughout your career. Save this room for the time when you really need it, to reduce your taxable income.

This doesn’t mean that you shouldn’t start investing early, it just might make sense to start with a TFSA and then switch those funds to an RRSP when you need the tax-breaks.

Long-game planning includes anticipating the rising marginal tax rate that comes with career success. Your Carte Financial Group Advisor can help project the optimal time to begin leveraging RRSP deductions.

What is the best way to make an RRSP grow?

The benefits of tax-free compounding, combined with numerous years of investing, can grow your RRSP successfully. Provided you resist withdrawing money from it.

The investment may be yours but dipping into it will derail this process. As part of your long game, ensure there’s an emergency fund planned. Don’t use the RRSP.

Because tax is automatically withheld from any withdrawals, it reduces the amount you would receive. You will also permanently lose the contribution room. Check out the Home Buyers’ Plan (HBP) and the Lifelong Learning Plan (LLP) for the only two exceptions to this rule.

Make it a goal to get this retirement fund prospering strongly, with years of compounded growth turning it into a bountiful nest egg. Work with your Carte Financial Group Advisor to plan a mix of investments with promising long-term growth potential.

When is the best time to take money out?

At the age of 71, you are required to start withdrawing from an RRSP by converting it into a Registered Retirement Income Fund or an annuity. But you may want to start withdrawals earlier.

It will depend on other available sources of income as well as the tax strategy you’re using. This is another time to play a long game to ensure continued financial success.

Project the income you expect to live on throughout retirement. If it’s modest, then steady RRSP withdrawals will result in a fairly light tax burden.

However, if your income will remain high as a senior, you need a different approach. One that protects your government benefits from being clawed back.

In some cases, it makes sense to cash out an RRSP over a shorter period of time. It could protect other benefits. You could then pursue other investment strategies such as maximizing a Tax-Free Savings Account.

Your RRSP is a vital part of a great retirement plan. Employ a long game to make it work to your benefit throughout your career. Ask your Carte Financial Group Advisor to show you how.